Hey there! Today, let's delve into the fascinating world of Litecoin and establish its position in the ever-evolving cryptocurrency market. Whether you're a seasoned investor or simply crypto-curious, understanding Litecoin's journey and status will equip you with essential insights.

莱特币的历史与发展简介

Diving right in, Litecoin was born out of a desire to improve the Bitcoin protocol. Launched by Charlie Lee in 2011, it was crafted to present faster processing times and lower transaction costs, all while maintaining a decentralized framework. What started as an experiment quickly attracted a following due to its pragmatic approach to enhancing blockchain technology. Over the years, Litecoin has consistently ranked as a top player in the crypto space, adapting and growing with each wave of tech advancements.

莱特币在加密货币市场中的地位

Now, let's talk about where Litecoin stands in the grand scheme of things. Amidst thousands of cryptocurrencies, Litecoin has managed to maintain its presence as a reputable and widely recognized coin across global exchanges. It is often referred to as the silver to Bitcoin's gold, denoting its reliability as a transactional medium complementing the more 'store of value' role of Bitcoin. This status is not just about market capitalization but also about the vibrant community and continued innovation that drives Litecoin's relevance even today.

By weaving through its history and current market standing, one can appreciate the unique position Litecoin holds within the cryptocurrency realm. This setup provides a crucial backdrop as we dive deeper into the technical aspects and market dynamics of Litecoin in the subsequent sections.

Now that we've covered the introduction and market position of Litecoin, it's time to dig a bit deeper into what really makes this digital currency tick. For those interested in the technical side or considering it as an investment, understanding these basics is essential.

莱特币的技术运作机制(挖矿过程和算法)

Let's talk mechanics. Litecoin operates on a concept similar to Bitcoin but with a few notable tweaks designed to improve speed and efficiency. It uses a proof-of-work algorithm, but unlike Bitcoin’s SHA-256, Litecoin uses a memory-hard algorithm called Scrypt. This crucial difference makes Litecoin's mining process more accessible because it requires less computational power, promoting greater decentralization.

The mining itself is a fascinating process. Miners vie to solve complex mathematical problems with their computer hardware, and the first to solve the problem gets to add a new block to the Litecoin blockchain. This block records transactions and the miner is rewarded with newly minted Litecoins. Due to its faster block generation time—about 2.5 minutes compared to Bitcoin’s 10 minutes—transactions are processed quicker, which has been a major selling point.

莱特币与比特币的比较

Now, onto the comparison with Bitcoin, the giant in the room. While both Litecoin and Bitcoin share the same underlying principle, Litecoin was actually tailored to address some of Bitcoin’s limitations. Apart from the faster transaction time and different mining algorithm I just mentioned, Litecoin also offers lower transaction fees, which makes it more appealing for daily transactions.

Moreover, Litecoin was designed to produce a total of 84 million Litecoins, exactly four times the amount of Bitcoin, aiming to make it more accessible and prevent too much centralization of wealth. This higher limit also helps in controlling the per-unit price, making it less intimidating for new users.

By leaning into these unique features, Litecoin has carved out its own niche in the crowded cryptocurrency marketplace. I've found that diving into such comparisons not only helps in grasping what makes each coin unique but also in making informed decisions when diversifying your crypto portfolio.

As we pivot into understanding the supply dynamics of Litecoin, it is crucial to grasp both its distribution mechanisms and the current status of its supply. This deeper look not only informs us about its scarcity but also provides insights into future availability.

莱特币的分发模式与发行极限

Entering the realm of Litecoin's supply, think of the whole system as a well-oiled machine set to deliver a finite resource. While the total cap is set at 84 million Litecoins, the way these coins enter circulation is through the mining process which I discussed earlier. The choice of a 2.5-minute block time and the use of Scrypt algorithm ensures a steady, yet moderately rapid supply of new coins. This balance aims to maintain a healthy level of liquidity and accessibility in the market.

What’s fascinating here is the halving process, which occurs roughly every four years, cutting the rewards for mining a block by half. This deflationary mechanism was programmed into Litecoin to ensure that it does not suffer from the detrimental effects of inflation, preserving its value over time. The last halving occurred in August 2019, reducing the block reward from 25 to 12.5 Litecoins, and the next is expected in 2023.

当前莱特币流通量与预测未来变化

Now, let's chat numbers – as of the latest data, there are about 66 million Litecoins already in circulation. This equates to approximately 79% of the total supply being mined. With each halving and with every new Litecoin mined, we inch closer to the total supply cap, making Litecoin increasingly rare.

The anticipated future of Litecoin supply is intriguing. As we approach the cap, the incentive structure for miners will shift from block rewards to transaction fees. This change is expected to maintain the mining activity essential for transaction validation and network security. This transition, coupled with a capped supply, could likely contribute to a long-term increase in Litecoin’s value, assuming demand holds or increases. The scarcity effect, well-documented in economic theory, might play out vividly here.

Wrapping up this section, understanding Litecoin's current and future supply dynamics is vital. It not only gives us a snapshot of where it stands today but also helps us anticipate how these dynamics could shape its future. Think of this as keeping a keen eye on the horizon, where past patterns and future projections collide to form investment strategies.

Jumping into the current dynamics of Litecoin's market prices, let’s explore recent fluctuations and what they mean for you as an investor or crypto enthusiast. Understanding these changes helps in making informed decisions and might just pinpoint why Litecoin deserves a spot in your investment portfolio.

最近莱特币的市场价格及其波动因素

So, I've been keeping an eye on Litecoin's price trends, and let me tell you, it's been quite a ride. Recently, the price has shown significant volatility, a common trait in the cryptocurrency world. Factors such as market sentiment, regulatory news, and technological advancements play substantial roles in this. For instance, when there's positive news about technological improvements or integration into new payment systems, prices tend to spike. Conversely, regulatory clampdowns or negative news can cause prices to plummet.

Just last month, Litecoin saw an uplift after an announcement of partnership with a major payment gateway. The excitement around such news brings in a lot of trading volume, and prices can swing quite a bit. It’s vital to keep an eye on these developments as they can provide trading opportunities or cautionary signals.

莱特币市场价格对投资者的影响

Now, let's talk about the impact of these price movements. As an investor, volatile markets can be both a nightmare and an opportunity. If you're savvy, quick on your feet, and do your homework, short-term fluctuations in Litecoin's price can be lucrative. However, they can also pose significant risk if decisions are made hastily or based on incomplete information.

Long-term investors might view volatility differently. Seeing beyond the noise of daily price movements could focus on the underlying value and technology of Litecoin. If you believe in the stability and future prospects of Litecoin, short-term fluctuations might seem less intimidating. It’s all about perspective and investment strategy.

In wrapping up this chat, keeping an eye on market dynamics, understanding the factors influencing price changes, and assessing your risk tolerance and investment strategy are crucial in navigating the waters of Litecoin investing.

Peering into the crystal ball to gauge the future prospects of Litecoin and dishing out some pointers for potential investors—let’s dive deep into what the horizon holds for this digital currency and how you can position yourself.

分析当前市场趋势对莱特币的影响

Lately, I've been analyzing the broader market trends, and it’s intriguing to see how they interplay with Litecoin's journey. The rise of fintech innovations and an increased emphasis on digital currencies by corporations and governments underline a promising trajectory for cryptocurrencies including Litecoin. Yet, the crypto environment is admittedly turbulent with regulatory shifts playing a significant role.

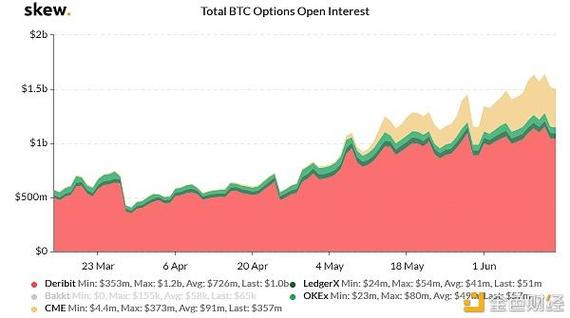

An interesting aspect to note is the entry of institutional investors into the crypto scene. Their presence brings a level of credibility and stability to currencies like Litecoin. It changes the game by potentially reducing extreme volatility and ensuring a more sustained interest over long periods. These elements make it a tad easier to predict a favorable future for Litecoin, yet caution always pervades due to inherent market unpredictabilities.

提供给潜在莱特币投资者的建议

For the budding Litecoin enthusiast or the seasoned investor pondering whether to deepen their Litecoin holdings, here’s my two cents. Diversification is key in any investment strategy and it holds especially true in the volatile world of cryptocurrencies. Don’t put all your eggs in one basket.

Staying informed cannot be overstated. Keep abreast with not only Litecoin’s news but also global economic indicators that could indirectly impact its performance. Make use of advanced analytic tools and historical data trends; they offer insights that could guide your investment decisions sagely.

Lastly, always consider your risk tolerance. Litecoin, like any cryptocurrency, presents significant risks and high rewards. If you’re someone who loses sleep over intense fluctuations, recalibrating your investment to align with more stable assets might save you some grey hairs. On the flip side, if you thrive in dynamic markets and have confidence in your risk management strategies, Litecoin might just be a worthy addition to your portfolio.

As we wrap up, remember that navigating the Litecoin waters requires a blend of caution, knowledge, and sometimes, boldness. Whether or not you choose to invest in Litecoin, staying informed and prepared is your best bet in making wise investment choices.

评论留言

暂时没有留言!